WeChat ID :

Login/Register

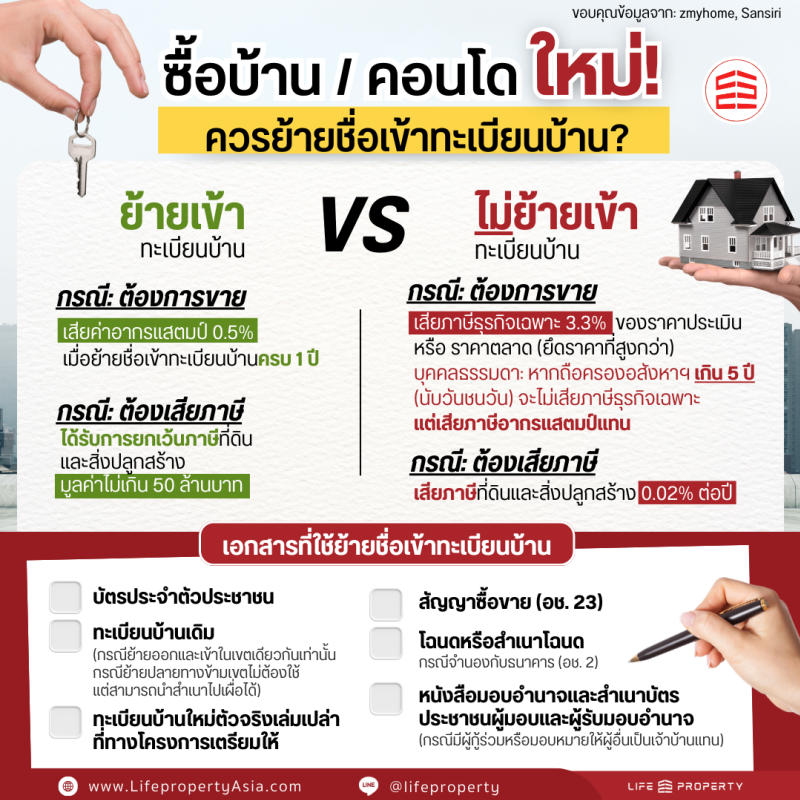

Ever wondered why registering your name on the house book (Tabien Baan) matters? For new homeowners or condo buyers, this simple step can significantly impact your taxes and expenses. Let Life Property break it down for you, along with some helpful FAQs.

📌 Scenario: Selling Your Property

📌 Scenario: Annual Tax Obligations

📝 Required Documents:

1. What if I own multiple homes?

You can only have your name in one house book at a time. You may use a relative’s name or leave the house book blank. However, for tax-saving benefits when selling, your name must be on the house book for at least one year.

2. What about jointly owned condos?

If two people are listed on the title deed, both names must appear on the house book to qualify for the SBT exemption.

3. Can I move out after one year and still keep the tax benefits?

Yes! Once your name has been registered for one full year, you can move out, and the SBT exemption remains valid.

4. What if I bought the property under a company name?

Unfortunately, companies are not eligible for SBT exemptions and must pay the full 3.3% tax.

5. What’s the difference between a “household head” and a “homeowner”?

Registering your name on the house book can save you a significant amount in taxes, especially if you’re planning to sell in the future. While the house book doesn’t prove ownership (the title deed does), it’s a smart move to cut down on unnecessary expenses!

Need more help?

Feel free to contact the Life Property team for free advice!

💬 Fast response via Line: @lifeproperty